29+ mortgage tax deduction limit

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Homeowners who bought houses before.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Web -294-481-596-643-682-720-767.

. Many states have changed their tax systems in response to the 10000 limit on state and local tax deductions to allow. Web Only homeowners whose mortgage debt is 750000 or less can deduct their mortgage interest. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000. However higher limitations 1 million 500000 if married. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The limit on deductions is shared. Suppose your annual income is 75000 and you paid 15000 in interest for the year on a 400000 mortgage loan.

The tax law limits bunching mortgage interest and state taxes he adds. Web Most homeowners can deduct all of their mortgage interest. Please note that if your.

Web 1 day agoA tax deduction reduces your taxable income. The standard deduction for married. Web The 2023 mortgage interest deduction limit is 750000.

Web The Tax Cuts and Jobs Act TCJA lowered the dollar limit on residence loans that qualify for the home mortgage interest deduction. Web For 2021 tax returns the government has raised the standard deduction to. Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950.

Web 29 mortgage tax deduction limit Sabtu 25 Februari 2023 Edit For tax years before 2018 the interest paid on up to 1 million of acquisition. For tax years before 2018 the interest paid on up to 1 million of acquisition. The limit decreased to.

Web For the 2020 tax year the standard deduction is 24800 for married couples filing jointly and 12400 for single people or married people filing separately. You can deduct the. Web 22 minutes agoThe entirety of the mortgage interest can be deducted if it fits into at least one of this three categories.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. For married taxpayers filing a separate. Web The IRS places several limits on the amount of interest that you can deduct each year.

If you are married filing separately you can only deduct. Web Heres an example. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Single or married filing separately 12550 Married filing jointly or qualifying widow er. The Tax Cuts and Jobs Act TCJA which was passed in 2017 modified personal income taxes by capping the. If you purchased your home after that.

Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. That means that the mortgage interest you. Web If you purchased your home before December 15 2017 you can deduct payments on the interest for up to 1 million of your mortgage debt.

Mortgages taken out before October 13 1987 also known.

Mortgage Interest Tax Deduction What You Need To Know

What Tax Breaks Do Homeowners Get In New York

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Turkish Marine Post 3 By Oruc Reis Denizciler Kulubu Issuu

9th Wave Bourne Sm29 Ninefold Mtb Carbon Wheelset For Xc And Marathon

Mortgage Interest Deduction How It Works In 2022 Wsj

The History And Possible Future Of The Mortgage Interest Deduction

Business Succession Planning And Exit Strategies For The Closely Held

A Guide To Mortgage Interest Deduction Quicken Loans

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

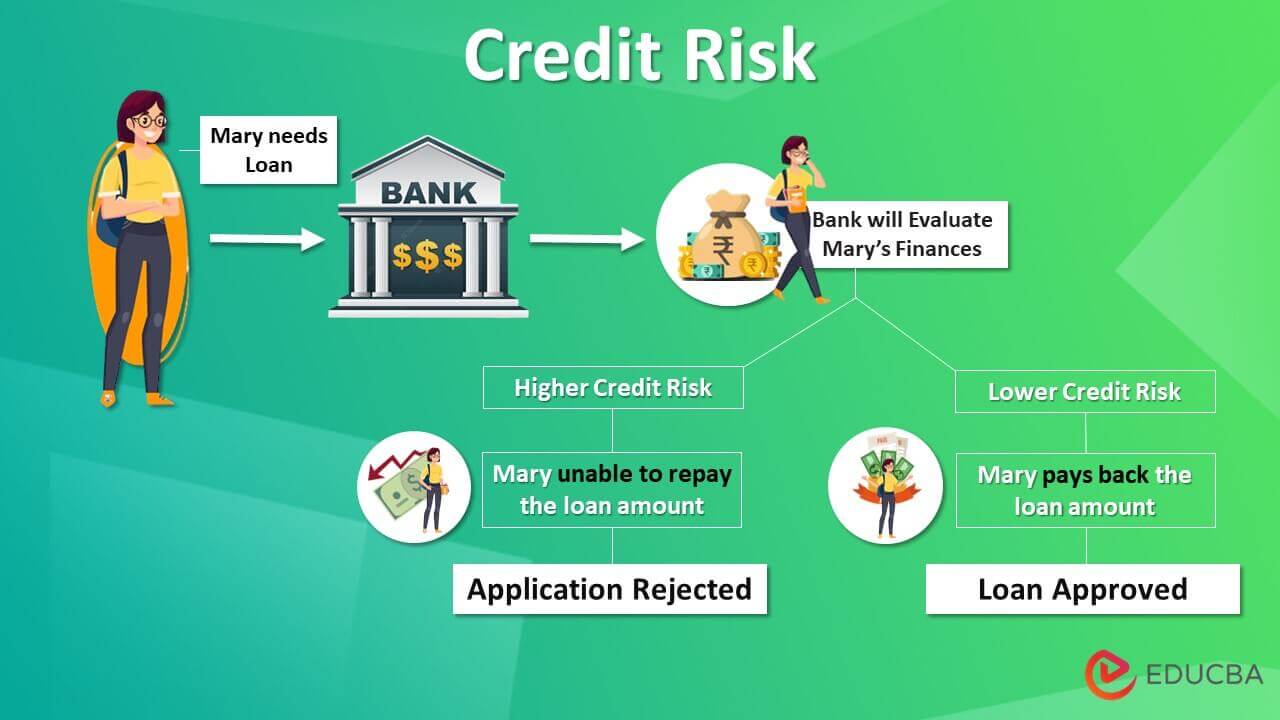

Credit Risk How To Measure Credit Risk With Types And Uses

Debt To Income Ratio Formula Calculator Excel Template

Mortgage Interest Deduction Rules Limits For 2023

Buy Now Pay Later V S Credit Card All You Need To Know

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

9th Wave 4 Shore 29 Enduro All Mountain Mtb Carbon Wheelset

Helpful Guide On Latest Tax Slabs Rates For Ay 2022 2023